The year 2024 opened with New South Wales Police receiving an influx of alarming reports from various automotive finance companies regarding highly suspicious car loan applications.

Numerous high-value loans were being approved for luxury vehicles, yet police surveillance revealed that when they checked the locations where these vehicles should have been, the cars were nowhere to be found. Recognizing an immediate red flag, the police launched a formal investigation.

Initial analysis revealed that many applications used stolen identities. As investigators pursued the financial transactions, a far more complex criminal network emerged.

The group was not just targeting car loans; they utilized the same deceptive methods to acquire business loans, mortgage loans, and systematically extract massive sums of money from various banks and financial institutions through organized and systemic fraud.

By mid-2025, the extensive investigation led to the arrest of eight initial suspects. Two male leaders of the group were charged with nearly 200 counts of fraud and money laundering.

Search warrants executed by the police uncovered approximately $38 million Australian dollars (over Php1 billion) in assets, including expensive cars, designer watches, and large amounts of cash. While the initial arrests seemed successful, investigators quickly realized that key figures remained actively operating in the shadows.

The Fraud Queen and The Illusion of Spiritual Wealth

Continued monitoring of suspicious financial transactions led investigators to the bank account of a Vietnamese-Australian woman named Anya Pan (53). Anya, who migrated to Australia in 2001 and later became a citizen, owned an immense property portfolio, including a $9 million (Php500 million) luxury mansion in Dover Heights.

This four-bedroom property boasted a private cinema, gym, sauna, and a high-end swimming pool. Beyond the mansion, Anya owned an extensive collection of designer handbags, high-value jewelry, including 40 grams of gold valued at $10,000 (Php500,000), and thousands in cash and casino chips.

The most damning revelation for investigators was the fact that Anya had held no official employment for over two decades and was, in fact, collecting government disability benefits. The question became: How could an unemployed person afford such an extravagant lifestyle? The investigation soon confirmed that Anya’s entire wealth was derived from illegal proceeds generated by massive fraud schemes.

She was quickly identified as one of the principal leaders of the Penthouse Syndicate, a financial crime organization considered one of the most sophisticated in Australian history. Police described the Penthouse Syndicate as a fully organized corporation of deception, meticulously structured to steal massive amounts from banks and financial institutions.

How did this woman ascend to the top of a criminal empire in a foreign country? The answer lay in her masterful construction of a façade: an impeccably clean, perfect persona that commanded trust and eliminated all doubt. Years earlier, Anya began immersing herself in the Vietnamese community in Sydney, attending temple festivals, Tết markets, and making frequent small, visible donations. She gradually built a reputation for generosity. At these public events, Anya Pan presented herself as an expert fortuneteller, proficient in astrology, destiny charts, and capable of seeing the future.

The Fortunetelling Scam: A Corporate Fraud Modus Operandi

As her reputation grew, so did the belief in her supposed accurate predictions of luck, wealth, and destiny. Many believed she could identify a person’s “benefactor”—a sign that someone was about to experience immense financial success.

As her fame spread, more people sought her counsel on property, feng shui, and general luck. This was the precise first step of Anya’s carefully orchestrated, years-long plan.

When Anya identified someone experiencing financial difficulties, she immediately struck. She would plant sweet, irresistible promises: Take out an investment loan; your benefactor is arriving soon.

Or, Buy a a new car, expand your business—a great blessing is coming. She directly targeted the public’s deep-seated desire for immediate life change and prosperity. Anya boasted of owning “lucky charms” and feng shui techniques capable of activating immense luck. However, she always insisted that a small initial investment was required to make the magic work.

Clutching onto hope, many victims interpreted the large loans Anya urged them to take as “spiritual offerings.” They were told to borrow the money first, and the divine guidance would ensure the money returned with immense interest.

Consequently, victims began taking out loans precisely as Anya commanded. Her method was brilliant and entirely self-protecting: she never placed her own name on any loan documents. All loans were taken out in the victims’ names, directly from banks and finance companies.

Money Laundering and The $70 Million Fraud

Police established that Anya Pan operated as the “director,” while the victims acted as the “principal actors” in her debt scheme. She coached them on how to fill out the complex loan applications and how to fabricate convincing financial profiles to secure large sums, often hundreds of thousands of Australian dollars per person. Victims who didn’t qualify were sent to loan brokers—accomplices within the syndicate—who expertly forged the necessary documents.

Her goal was simple: ensure every person borrowed the maximum amount possible. In one documented case, a victim was coerced into taking out 10 different loans, totaling nearly $1 million Australian dollars, sourced from various banks and financial institutions, including car financing, business loans, and home equity lines.

Once the loans were approved and the money disbursed, Anya and her associates immediately claimed the funds, often portraying it as ritual money to “open the luck” or claiming she needed to invest the money under divine guidance.

Anya ensured that she personally profited immensely from every successful scheme, netting no less than $100,000 USD (Php6 million) for herself, while the rest was immediately transferred to syndicate-controlled accounts.

The victims were left with barely anything—sometimes a token “blessing” of a few thousand dollars. Police estimate that nearly $70 million USD (over Php4 billion) was stolen using this systematic method.

Once the money was acquired, Anya launched into the money laundering phase. Her preferred method was casino gambling. Projecting the image of a wealthy, lucky socialite, she would purchase massive amounts of casino chips, play briefly without seriousness, and then cash out the chips as “clean” money.

In one instance, she laundered over $400,000 (Php20 million) in just two months at a Sydney casino. Her high-volume transactions elevated her to VIP status, further facilitating the concealment of her illegal earnings.

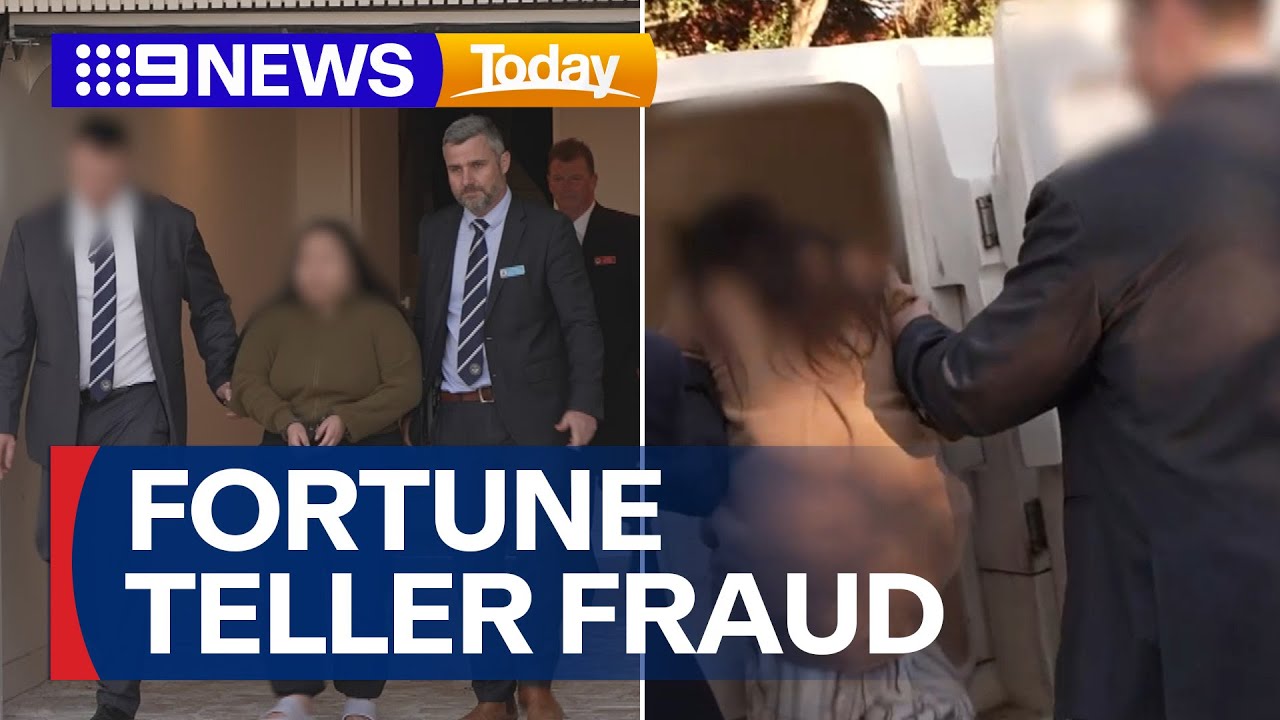

The Raid, The Evidence, and The Arrest of Mother and Daughter

The syndicate utilized shell companies, convoluted bank transfers, and large-scale asset purchases to legitimize the stolen funds. By May 2025, business records showed Anya had established a new company registered in Lewisham, likely a vehicle for her vast property acquisitions. Just one month later, in June 2025, that company purchased the $9 million luxury mansion in Dover Heights, which rapidly became Anya’s headquarters.

She did not stop there. She purchased a $3.5 million apartment in Rose Bay in her daughter’s name and acquired several luxury vehicles and additional gold bars for storage.

Throughout this massive operation, Anya was aided by her daughter, Teya Pan (25), who served as a crucial accomplice, assisting with financial transactions, cash withdrawals, and holding assets. Their social media was filled with images of lavish parties and international vacations, projecting an elite image—all funded by the suffering of their own community.

After months of surveillance, the police decided to act. On November 12, 2025, at 6:00 AM, the Middleton Task Force and the Elite Raptor Squad silently surrounded the Dover Heights mansion.

Officers scaled the neighbor’s fence for a clandestine approach. Once positioned, the tactical units breached the mansion’s door. Anya and Teya were awakened by the intrusion, screaming in confusion, and were quickly arrested and taken into custody.

The subsequent search of the mansion was exhaustive. Police discovered a trove of financial documents, loan applications, and bank files. Most damning was a black ledger notebook found in Anya’s feng shui-inspired office, detailing every victim’s loan amount, profit percentages, and annotated with handwritten feng shui notes.

They seized dozens of cell phones and electronic devices containing crucial evidence of communications between Anya, her conspirators, and the victims. They also confiscated the extensive collection of designer handbags and, from her safe, gold bars, casino chips, and large denominations of cash—all indicators of money laundering.

The Legal Aftermath and The Road to Trial

The police immediately froze all assets owned by Anya and Teya, including the Dover Heights Mansion and the Rose Bay Apartment, to ensure the funds could be confiscated upon a guilty verdict.

Concurrently, police interviewed numerous individuals, primarily Vietnamese immigrants—many of whom were middle-aged and financially vulnerable—who had taken out loans under Anya’s guidance.

Many admitted they were unaware they were part of a criminal operation, believing they were participating in a spiritual ritual that would bring them prosperity. Tragically, some victims were also arrested and charged as part of the syndicate, now facing both massive bank debt and money laundering charges.

Investigators believed they had successfully reached the highest operational level of the Penthouse Syndicate, with Anya having assumed leadership after the previous leaders were arrested in mid-2024.

However, Anya remained mostly silent during initial questioning, denying the allegations and claiming she was merely assisting people with loans. Teya, however, cooperated, providing information on bank accounts and associates, possibly hoping to mitigate her own criminal penalty.

Police suspected professional assistance from lawyers, accountants, or bank employees who either looked the other way or actively helped forge documents and conceal the money’s origins.

Given the magnitude of the $70 million fraud, police were determined to dismantle the entire network, collaborating with the Australian Securities and Investments Commission to trace funds through lawyer trust accounts and large property acquisitions. The size of Anya’s property acquisitions had already raised concerns about market distortion in Eastern Sydney.

Anya Pan was formally charged with 40 criminal cases. The most severe charge was leading an organized criminal group—a crime carrying a maximum penalty of 25 years confinement.

She also faced 19 counts of obtaining money by deception (up to 10 years each) and three counts of dealing with the proceeds of crime (money laundering, up to 15 years each). In total, she faced a potential sentence exceeding 100 years.

Legal experts confirmed that due to the scale of the fraud, Anya would almost certainly face decades of confinement if convicted on the main charges.

Teya Pan faced lighter charges: two counts of fraud, two counts of identity abuse, one count of money laundering, and one count of participating in a criminal organization. She was granted bail, largely because of her minimal role, lack of prior criminal record, and age. Both mother and daughter are scheduled for a court hearing in January 2026.

The case stands as a massive warning to the Vietnamese community and the broader public about the dangers of blindly trusting individuals who blend spiritual claims with financial schemes. The deep-seated human desire for a better life was the weakness Anya Pan expertly exploited, reminding everyone that fortune and hope cannot be bought through deceit.

News

Habang Umiiyak ang Isang Bilyonaryo sa Puntod ng Kanyang Anak, Isang Pulubing Batang Babae ang Lumapit na Kamukhang-Kamukha Nito—Ang Lihim na Kanyang Natuklasan ay Yumanig sa Buo Niyang Pagkatao at Nagpabago ng Lahat. 😱💔

Kabanata 1: Ang Alingawngaw ng Kahapon Ang kulay abong langit ng Manhattan ay tila sumasalamin sa bigat na dumudurog sa…

Akala ng lahat ay talunan na si Elena matapos siyang iwanang walang-wala ng kanyang sakim na asawa, ngunit hindi nila alam na ang kanyang kapatid na isang Navy SEAL at ang kanyang nanay na isang batikang abogado ay nagluluto na ng isang planong wawasak sa buong imperyo ng lalaking umapi sa kanya.

Kabanata 1: Ang Masamig na Katahimikan ng Katotohanan Tahimik ang loob ng silid ng hukuman, isang katahimikang mabigat at tila…

Isang Nurse ang Sinisante Matapos Iligtas ang “Pulubi” sa ER, Ngunit Nagulantang ang Lahat Nang Dumating ang Dalawang Military Helicopters sa Highway Para Sunduin Siya—Ang Pasyente Pala ay Isang Delta Force Captain na Target ng Isang Milyonaryong Doktor!

Kabanata 1: Ang Anghel sa Gitna ng Unos Ang mga ilaw na fluorescent sa St. Jude’s Medical Center ay may…

Isang palaboy na ina ang nagmakaawa para sa “expired cake” para sa kaarawan ng kanyang anak, ngunit ang hindi niya alam, ang lalakeng nakatitig sa kanila sa dilim ay ang pinakamapangyarihang mafia boss sa lungsod. Ano ang nakita ng malupit na lalakeng ito sa mga mata ng bata na naging dahilan ng pagguho ng kanyang imperyo? Isang kwentong hindi mo dapat palampasin!

Kabanata 1: Ang Butterfly Cake at ang Estranghero sa Dilim Isang ordinaryong hapon lamang iyon sa Rosetti’s Bakery sa gitna…

Akala nila ay isang hamak na waitress lang siya na tagalinis ng basag na baso, pero nang bigkasin niya ang isang sikretong salita sa harap ng makapangyarihang bilyonaryo at ng kanyang matapobreng ina, biglang gumuho ang buong imperyo! Isang lihim na itinago ng ilang dekada ang mabubunyag—sino nga ba ang babaeng ito at bakit takot ang lahat sa kanya?

Kabanata 1: Ang Alingawngaw ng Nakaraan Walang sinuman sa silid na iyon ang naglakas-loob na magsalita sa kanya. Hindi dahil…

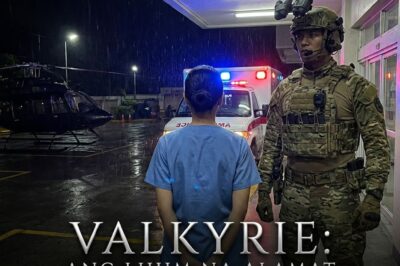

Isang “mahina” at nanginginig na nurse ang pilit na pinahiya, minaliit, at sa huli ay sinisante ng isang mayabang na doktor—ngunit ang buong ospital ay niyanig nang biglang lumapag ang isang itim na helicopter ng militar sa parking lot para sunduin siya! Sino nga ba talaga ang misteryosong babaeng ito na tinatawag nilang “Valkyrie”?

Kabanata 1: Ang Alamat na Nakatago sa Dilim Ang ingay ng mga fluorescent lights sa St. Jude’s Medical Center sa…

End of content

No more pages to load